March 1, 2019

Time: 8.45 am

Pre Market Report:

Time: 8.45 am

Pre Market Report:

- US markets closed slightly lower.

- Asian markets are generally positive.

- SGX Nifty is almost flat.

- Yesterday as expected Nifty expired between 10780 and 10860.

- This is the fourth expiry Nifty is expiring between 10780 and 10860.

- Yesterday Nifty tried to break above 10850 two times but met with selling pressure.

- In the last half an hour HDFC Bank fell more than 20 Rupees bringing both Nifty and Bank Nifty down.

- But FIIs have bought for more than Rs 2000 crores and that a great positive news.

- But DIIs selling for more than Rs 5000 crores is even a grater negative news.

- It seems that retail people start losing interest and withdrawing money from Mutual Funds.

- But only Nifty is down but mid caps and small caps are doing well.

- March is only 18 trading session series.

- We need to see whether market makes a significant move.

- Election dates will be announced next week.

- If the election results counting day falls on a holiday, volatility will shoot up.

- If at all there is any pre election rally, that should start now.

- We have already consolidated for 4 months, that is a very long consolidation.

- FIIs turned net buyers, Global cues are good, if the border issues is seen as positive for BJP, then the rally may start in this series.

- US China trade agreement may also happen in March.

- It is a good idea to sell 10500PE and 11200CE.

- We may adjust the trade as and when markets move.

- I have done Bank Nifty 27000 Straddle at Rs 1030. Additionally sold 27300CE last weekly expiry and pocketed Rs 35.

- Index heavy weights like Reliance, ITC, HDFC Twins, Kotak Bank all under performing for the last few days.

- Due to 3 day weekend, Nifty is likely to make a big move today.

- It could be on the higher side. But Futures seems to have priced in already, Bank Nifty future was at Rs 200 premium yesterday and Nifty future was at Rs 80 premium.

- Nifty future may trade between 10820 and 10950.

Comments

Thank you sir for your detailed analysis

ReplyDeleteThank you Sir

ReplyDeleteThank you sir.....��

ReplyDeleteGood morning sir.. . Have a good day

ReplyDeleteTHANKS

ReplyDeleteSir I have few questions for you please answer that

ReplyDelete1) How to earned/ maintain weekly cash flows through options and

2) Is it possible to maintain cash flow s in stock market as we havehin real estate in a form of rent

3) I saw your video of trading carnival where you told about your journey and other things.

You also told that you use FD for your margin requirements in options trading. But sir i also did some research regarding to that particular point and find that 90% of brokers not give margin against FD. So can you tell me your brokers name?

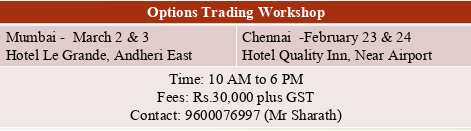

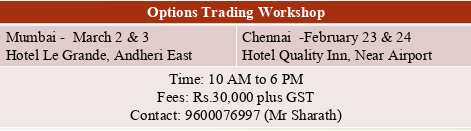

Contact Mr Sharath 96000 76997.

DeleteGreat sir, for your 27000 short straddle you are already in profit of more than Rs.100. How great. Till the time i was doing long straddle made lots of loss. There are lots of non sense people like me in the market. Now stopped buying option. Learning selling option from your videos and blogs. Thanks you sir.

ReplyDeletePost a Comment