November 4, 2019

Time: 8.10 am

Pre Market Report:

Time: 8.10 am

Pre Market Report:

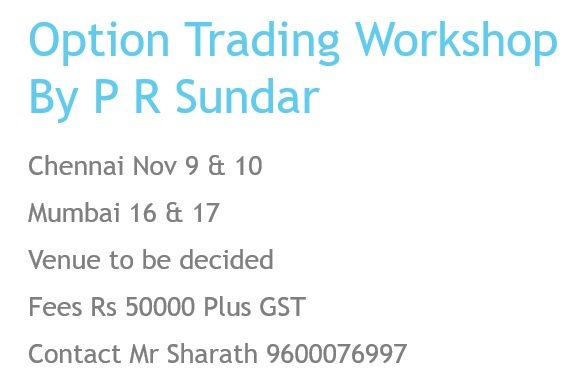

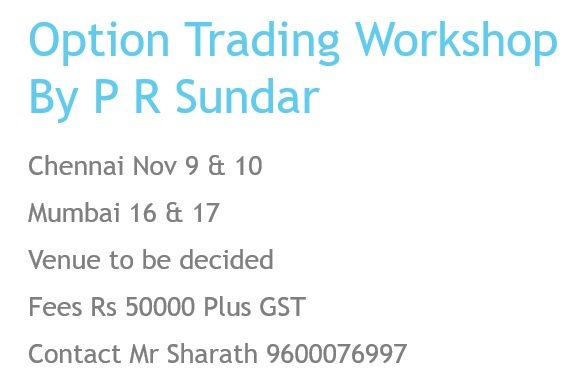

- There are only two more seats available for Chennai workshop.

- Those interested may contact 9600076997.

- My Online Trading Summit 2019 video will be available for free viewing only on Nov 6.

- Those interested may register at academy.traderwave.com/a/18629/vFUA2E

- Come to markets, Nifty after consolidating around 11700, Nirmala Candle high, now again trending.

- Logical next resistance is at ATH above 12K.

- Once all time high is tested, Nifty may go for another round of consolidation.

- So it is a buy on dip market now.

- On Budget day Nifty high was 11981.75.

- All Time High is 12K plus.

- So in the sjort term, Nifty will face resistance around 11980.

- For the last few days, HDFC BAnk, Kotak Bank, ICICI Bank, all top 3 constituents of bank Nifty, have been under performing.

- If they start moving higher, the Nifty All Time High is very easy.

- In fact, Nifty is just 1% away from all time high but Bank Nifty is 4 to 5% from all time high.

- Even on Nirmala Candle day, Nifty high was 11695 but Bank Nifty high was 30500.

- Now Nifty is far higher than 11700 but Bank Nifty is still lower than that.

- So it the huge under performance of Bank Nifty that is holding the Nifty from crossing all time high.

- Sooner or later that under performance will get corrected and Nifty will hit all time high.

- Another million dollar question today, Will YES Bank open positive or negative?

- Saudi princess has given approval for Saudi Aramco IPO, will that help Reliance today?

- SGX Nifty is trading around 11960.

- FIIs keep buying and they have bought for more than Rs 500 crores on Friday in Cash market.

- All these point to all time high soon.

- What will happen after that is another question.

- Will markets consolidate or drift lower?

- I sold Bank Nifty weekly option 29500PE naked as I am taking bullish view about Bank Nifty.

- I have dome some short straddles at 30500 and 31000 in monthly options.

- I am also holding some Nifty future long positions which I am planning to exit around 12050.

- Bank Nifty will be in focus as both ICICI and HDFC ADRs are up and due to YES Bank results.

- Nifty future may trade between 11880 and 12020.

Comments

Post a Comment